How Stablecoins Will Lead To Better Governance

This is Porter’s Daily Journal, a free e-letter from Porter & Co. that provides unfiltered insights on markets, the economy, and life to help readers become better investors. It includes weekday editions and two weekend editions… and is free to all subscribers.

The GENIUS Act heads to the president’s desk… Shares of Circle rose 32%… Stablecoins will shatter the entire banking system… Innovation happens at the fringes: meet Dave… The government will be forced to manage its currency responsibly… Cryptocurrencies surge under new legislation… |

Table of Contents

Yesterday, the U.S. House of Representatives voted 308-122 to pass the Guiding And Establishing National Innovation For U.S. Stablecoins (GENIUS) Act.

This legislation, which the Senate approved in June, lays out new standards and legal protections for issuers of stablecoins. The bill is now headed for President Donald Trump’s desk, where he is expected to sign it.

Shares of Circle Internet (CRCL), the purveyor of the widely used stablecoin USDC, rose from $190 to over $250 on the news.

As you know (and as I wrote about on Wednesday), I believe the development of stablecoins represents the biggest change in the world’s banking system since the advent of the telegraph. Western Union allowed consumers and institutions to send money, virtually immediately, at very low cost, to almost anywhere in the world.

This innovation created enormous new, global markets for commodities, driving down prices and creating tremendous wealth. Argentina, for example, became one of the richest countries in the world in the two decades after the installation of its first undersea cable to Europe in August 1874. Argentina saw its economy grow 7.5x in 20 years.

Stablecoins represent a way to completely disintermediate the entire banking system, replacing vaults with cryptography, and expensive private payment networks with the free internet. They also contain the key technological innovations necessary to remove expensive intermediaries between lenders and savers and between merchants and customers. This means incredible new services and benefits for consumers and, almost as good, the demise of traditional banks.

There’s nothing more frustrating to me than having to deal with banks, who refuse to pay a reasonable amount of interest on deposits, just to manage my company’s payroll. I don’t need the bank’s help to do this. The technology exists to pay my employees every day, immediately (not twice a month), using cryptography, the internet, and their cell phones.

The banks, of course, oppose this innovation.

Jack E. Hopkins is the chairman of the Independent Community Bankers Of America – the lobbying group for America’s community banks. He sent a letter opposing this legislation to the members of Congress last week. I found his concerns fascinating: he’s directly opposed to anything that’s good for his customers.

These bills… carry the potential to significantly impact America’s community banks and the businesses, families, and communities they serve.”

And therefore, he wants protection for the banks from technological disintermediation.

If properly crafted, the combined effect of these bills could provide much needed regulation to the growing digital assets market without jeopardizing investors, financial system stability, or disintermediating community banks.”

But why do we need the banks anymore, Jack? Why would a customer willingly choose to use your group’s banks if they didn’t absolutely have to? Nobody likes getting ripped off, Jack. With the government printing 8% to 10% a year in new money and your bank offering less than 1% a year on bill-paying accounts, you guys have been ripping our faces off for decades.

And we’ve had enough of it. That’s what Jack is afraid of. Read carefully:

Stablecoin and market structure legislation must not create a shadow banking system that offers fewer protections to consumers and imperils the ability of community banks to provide capital and credit to local communities. New stablecoin and market structure laws should first do no harm nor undermine the existing supply of credit. Lawmakers must work to fully mitigate the risks to the economy that would result from an outflow of community bank deposits to payment stablecoins.”

According to Jack, it’s the banks that have been providing credit to their communities. But, of course, that’s nonsense: it’s the depositors who have been providing all of the credit!

When technology changes in a way that eliminates the need for your industry’s critical function, the worst thing you can do is attempt to use Congress to protect your industry.

Think about what happened when music and movie streaming eliminated the need for CDs and DVDs. Trying to make music and movie streaming against the law wasn’t going to work. Turning your best customers into criminals isn’t a growth strategy. Instead, the entertainment industry had to pursue new business models that both protected copyrights and enabled massively lower distribution costs. That, in turn, benefitted consumers through lower volume pricing, which led to big increases in media consumption.

The banks are going to have to figure out how to live with stablecoin technology because it’s not going away. And their current approach – to request a ban on paying interest on stablecoins – will fail. Already providers like Coinbase will pay you a 4.1% “reward” for holding USDC. Similar incentives will develop. And adoption will soar.

Meanwhile, the bankers keep claiming the world will collapse without them:

Prohibiting yield-bearing payment stablecoins is critical to preserving credit availability in our financial system. Notably, the U.S. Treasury Borrowing Advisory Committee (TBAC) recently stated that yield-bearing stablecoins could divert $6.6 trillion of demand deposits from traditional financial institutions to the digital assets industry. Any migration from community bank deposits to stablecoins will shrink a funding source for local lending. The result will be reduced access to credit and less favorable borrowing terms, especially in smaller communities.”

Complete nonsense. Again, the banks do not provide the credit. The depositors do.

What Jack knows is this: as soon as it’s legal and convenient to take all of your money out of his member banks, you will do so.

The reason is simple. The institutions he represents cannot compete with emerging digital systems, which can provide all of the functions of a bank, including safeguarding assets, making payments, and providing credit, virtually for free.

These new technologies will not reduce the availability of credit, they will expand it massively. Stablecoins and other digital banking solutions can provide vastly better services, 24/7, at virtually zero cost, and with immediate settlement. These innovations will provide access to credit in new and better ways that are not possible with today’s banking systems.

As an example, just look at the incredible success of Dave, an online payday lender built using the latest AI technology.

Dave offers its services through an app, mostly to customers who do not have a traditional bank account. The company’s ExtraCash payday-lending product allows users to borrow up to $500 with no interest and helps these underserved consumers avoid traditional bank fees like overdrafts, with fee-free checking accounts. Since 2017, it has disbursed over $15 billion in ExtraCash advances. Overall, since 2021, its loan book has grown by 259%.

This gives you some idea about how much more lending and how much opportunity there is to unleash through lower cost, digital-based banking platforms. Dave’s stock is up almost 500% over the past year.

You can scoff at payday lenders if you want to. But innovations always occur at the fringes of an industry first. Porn, for example, was the first part of the media industry to adopt streaming. What’s happening with payday lenders now will happen to Citigroup (C) next.

While I am excited about how stablecoins will disintermediate banks over the next several years, the real potential in these technologies is to finally make sound money a reality for every American.

Wealthy Americans have always been able to shield themselves from the government’s constant monetary debasement by using leverage to buy assets (like houses and businesses), by owning gold, and by owning businesses (like P&C insurance) that profit directly from debasement.

Stablecoins and similar digital technologies will make it possible for everyone to do the same, but keeping their money in Bitcoin, which the government cannot print. Stablecoins will allow you to create payment tokens for exchange, in real time, while you keep all of your money in a sound currency.

Once no one has to hold dollars anymore to use payment networks, the government will be forced to manage its currency more responsibly. That market-based competitive pressure could lead to vast improvements in the governance of our country.

Just ask yourself, if we had to actually pay for the Vietnam War – instead of just printing the money – would it have happened? Stablecoins could effectively take away the government’s printing press by making it vastly easier to use Bitcoin.

And that would be the most powerful economic change in our country since the Civil War.

Want Porter & Co.’s Top Recommendation? It’s here…

VIDEO UP FOR A LIMITED TIME ONLY

FREE Ticker Symbol to Get Exposure to Elon Musk’s Next Company — Pre-IPO

A trusted venture capitalist is revealing how you can get exposure to Elon’s next trillion-dollar venture — before it IPOs.

And the best part? He’s sharing this virtually unknown ticker symbol for FREE. No strings attached.

👉 Get the ticker symbol now, completely free, no strings attached.

Three Things To Know Before We Go…

1. Congress’ “crypto week” ends with a bang. As noted above, the GENIUS Act has passed the House and will now go to President Donald Trump to be signed into law. However, the House also passed two other crypto-related bills last night: the Digital Asset Market Clarity (CLARITY) Act – intended to create a clear regulatory framework for other digital assets, and the Anti-CBDC Surveillance State Act – which as the name implies is intended to prohibit the creation of a Central Bank Digital Currency (“CBDC”) in the U.S. These bills are now headed to the Senate, where they’re also likely to pass. The crypto market clearly liked the news… the total crypto market capitalization soared above $4 trillion for the first time this morning.

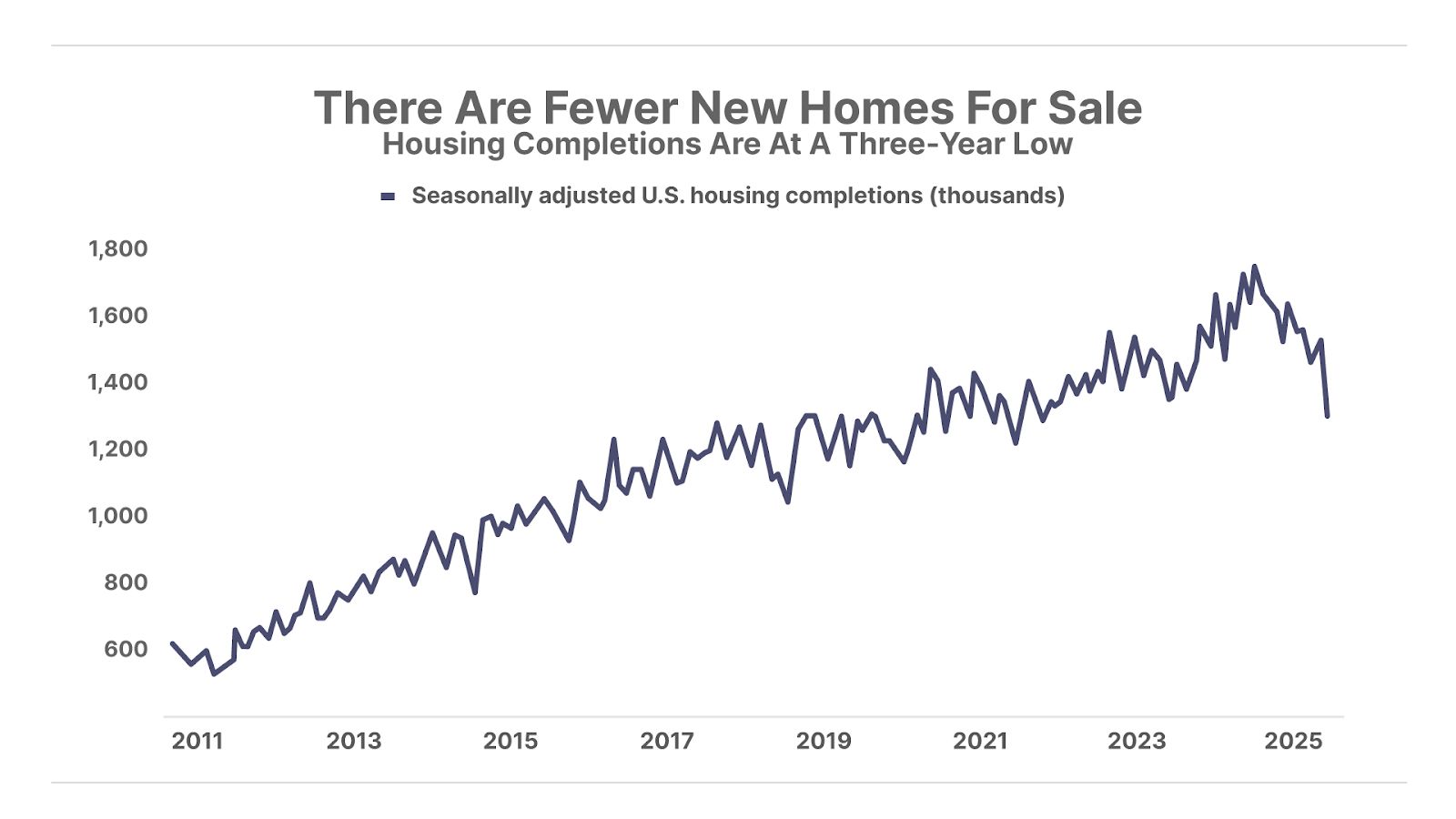

2. Housing market stalls. The number of U.S. homes completed for sale fell 24% year-on-year in June to 1.3 million, the lowest level in three years. High mortgage rates and record-high home prices are squeezing buyers out of the market, resulting in a growing glut of unsold inventory. Builders are responding by cutting back on new construction. The U.S. housing market will remain sluggish until long-term interest rates or home prices decline, or some combination of both.

3. Sentiment hits a five-month high as inflation expectations normalize. Despite a higher-than-expected inflation number released on Tuesday, Americans now anticipate that inflation will decline (as the expectations chart below shows). Sentiment has improved for two straight months, reflecting optimism that the most disruptive effects of President Trump’s tariffs may be in the past. Meanwhile, with stock markets at all-time highs, consumers are optimistic about their personal finances.

And One More Thing… Poll Results

In Wednesday’s Journal, we reported that the Trump administration had turned up the heat on Federal Reserve Chair Jerome Powell – not only criticizing his monetary policy but also blaming him for cost overruns at Fed headquarters in Washington, D.C. So we asked readers if they thought President Donald Trump would fire Powell before Powell’s term expires in just under a year… Nearly two-thirds of survey takers (66%) said no, while 34% said yes, the president would fire the Fed chair before May 2026.

Good investing,

Porter Stansberry

Stevenson, Maryland

Please note: The investments in our “Porter & Co. Top Positions” should not be considered current recommendations. These positions are the best performers across our publications – and the securities listed may (or may not) be above the current buy-up-to price. To learn more, visit the current portfolio page of the relevant service, here. To gain access or to learn more about our current portfolios, call Lance James, our Director of Customer Care, at 888-610-8895 or internationally at +1 443-815-4447.