- Porter's Daily Journal

- Posts

- Buying $1s For 20 Cents Is Rare

Buying $1s For 20 Cents Is Rare

Porter's Journal Issue #113, Volume #2

But These Opportunities Do Exist… Right Now, Mostly In Asia

This is Porter’s Daily Journal, a free e-letter from Porter & Co. that provides unfiltered insights on markets, the economy, and life to help readers become better investors. It includes weekday editions and two weekend editions… and is free to all subscribers.

Stop betting on ifs and whens… Opportunities in Korea… A chairman’s embezzling problem… A market leader in data storage… New jobs decline… The market shrugs off the shutdown – for now… Poll results about gold… |

Table of Contents

On Monday I retold the incredible story of Warren Buffett’s investment in the Philadelphia & Reading Corporation.

I’d urge you to read Buffett’s Early Investments by Brett Gardner. It details the full story of how CEO Mickey Graham extracted more than $400 million in value out of a 100-year-old, failing coal-mining business. Buffett’s investment, at one time fully half of his entire portfolio, was made below $10 per share and was sold at over $200 per share 13 years later.

The incredible thing to realize: value was there the entire time. Buffett wasn’t guessing. The capital simply had to be unlocked.

Think about how different that is from how you invest. You’re depending on future earnings. You’re betting on ifs and whens.

And, I admit, opportunities to buy $1s for $0.20 are rare. But they do exist. And right now they mostly exist in Asia.

Yesterday I attended the Grant’s Interest Rate Observer fall conference at the Plaza Hotel in New York. I’ve known Jim Grant for about 20 years. He’s a legend in our business and I’ve attended his conference regularly since the early 2000s.

About a year ago, he published this in his newsletter:

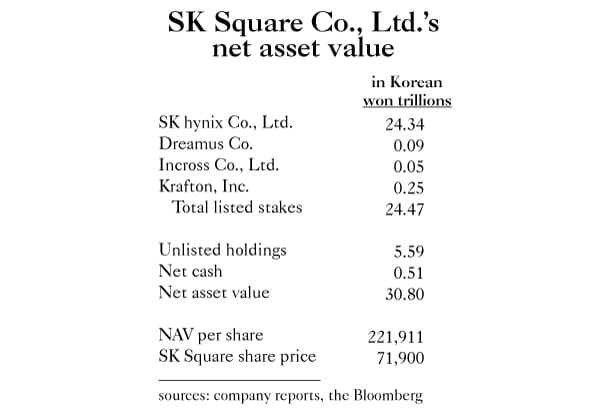

SK Square (402340 on the Korea exchange), as Jim’s brilliant analyst Evan Lorenz helpfully explained, is part of the SK chaebol, South Korea’s second-largest conglomerate after Samsung Group. And… well… let’s just say that SK isn’t exactly lily-white when it comes to Western corporate governance norms.