- Porter's Daily Journal

- Posts

- High Yield Precious Metals

High Yield Precious Metals

Porter's Journal Issue #1, Volume #3

How To Transform Your Portfolio Into An Income Machine

This is Porter’s Daily Journal, a free e-letter from Porter & Co. that provides unfiltered insights on markets, the economy, and life to help readers become better investors. It includes weekday editions and two weekend editions… and is free to all subscribers.

Today – taking a break from our normal publishing schedule – we are continuing our “12 Days Of Christmas” series.

Better than nine ladies leaping or 11 pipers piping, Porter & Co.’s version of the “12 Days Of Christmas” brings you something actually useful: hard-earned investment lessons to guide you through 2026. For the remainder of the year – in place of our regular research and insights – we will dish out key lessons from 2025… some earned from pain and others from gain.

Over the past year, editors across all of our publications have recommended stocks, bonds, or other trades that have resulted in a mix of outsized performances and humbling underachievements. Having begun December 23 and extending through tomorrow, we will reveal a pivotal lesson – about why a stock soared to double-digit returns, or why one languished. We will also explore the ones that got away – that we sold too soon or that we didn’t recommend at all.

Today, in our penultimate installment of “12 Days,” analyst Ross Hendricks shares with readers some lessons learned from his experience overseeing Porter & Co.’s Trading Club, which we launched on May 30, 2025… One takeaway: trading options does not have to be painful, risky, or costly. It’s actually a smart way to generate income and boost overall returns, regardless of what the market does.

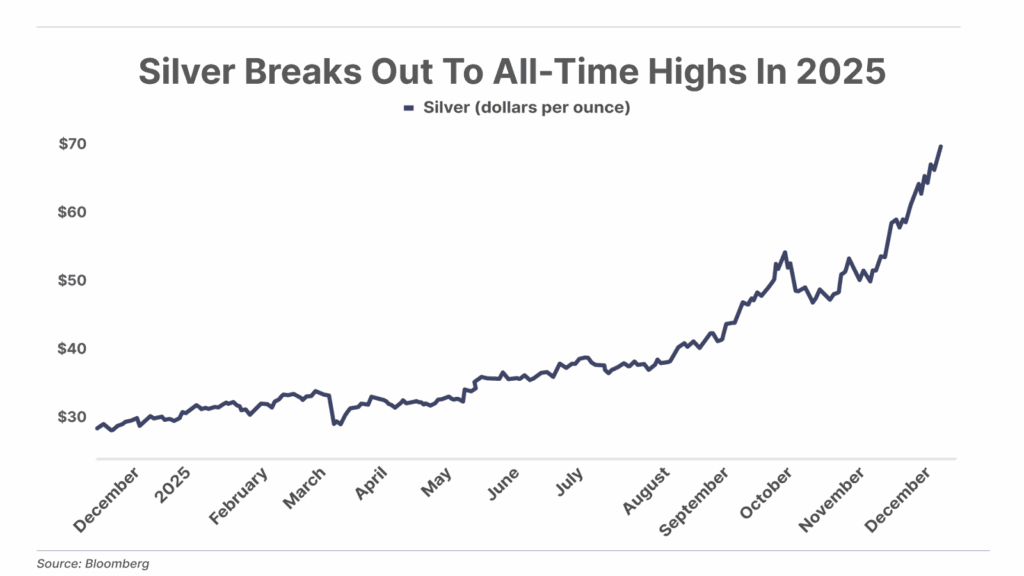

Silver is one of the best-performing assets in the world this year, ending 2025 with a gain well above 100%.

We first began altering readers about silver last year, in an October 2024 Daily Journal. At the time, the price of gold had been surging, but silver had not kept pace. Porter noted how the gold-to-silver price ratio indicated that the white metal had become extremely undervalued, and he predicted a breakout year ahead:

Look for silver to be one of the best-performing commodities of 2025.”

The key drivers of the precious metals bull market – runaway deficit spending and monetary expansion globally – remain firmly intact as we enter 2026. So while we remain bullish on gold and silver as the ultimate forms of monetary insurance, there’s just one problem…

As unproductive assets – precious metals don’t generate profits or cash flows – they merely shield investor purchasing power from monetary debasement. And yes, significant capital gains are possible from buying at the right price – like the 100% return for those who bought silver when we recommended it in October 2024. But ultimately, this upside requires other buyers to continue bidding up the price after you buy.

Inevitably, at some point in every precious metals bull market, buyers become exhausted. This can then lead to prolonged stretches of flat or negative returns. We saw this for silver and gold most recently in the 12 years from 2011 to 2023, and before that, the 26-year stretch from 1982 to 2008.

But what if you could transform your precious metals holdings into a consistent source of income, regardless of whether prices move up, down, or sideways? And what if you could do it without taking on any additional risk?

It may sound too good to be true, but I (Ross Hendricks) will show you how we did exactly that in The Trading Club in 2025. It’s an opportunity made available every single trading day in the options market.