What Most People Don’t Understand About Interest Rate Cuts

This is Porter’s Daily Journal, a free e-letter from Porter & Co. that provides unfiltered insights on markets, the economy, and life to help readers become better investors. It includes weekday editions and two weekend editions… and is free to all subscribers.

Trump fires Cook… Cook sues Trump… Market thinks rates are going down… Market thinks inflation’s going up… Few understand what rate cuts mean… Washington could try to spend less… See Porter & Co.’s new logo :)… |

Editor’s note: Porter has turned today’s Journal over to Distressed Investing senior analyst Marty Fridson.

Marty has a long background in trading, investing, and finance… Over a 25-year span with Wall Street firms including Salomon Brothers, Morgan Stanley, and Merrill Lynch, he became known for his innovative work in credit analysis and investment strategy.

Below, Marty shares some of the wisdom learned along the way. He offers up an analysis of how a reduction in interest rates by the Fed does not necessarily have the outcome for Treasury bonds that many in the financial community anticipate…

Marty offers up the details now…

We will not be publishing the Saturday Stock Screen and Sunday Investment Chronicles this weekend. Both will resume on September 6 and 7… And please note that with the markets closed on Monday, September 1, for Labor Day, we will not publish Porter’s Daily Journal.

The Fed’s interest rate prescriptions play prominently in discussions about financial markets, but recent news on the topic has been unusually sensational.

It has included U.S. President Donald Trump’s unprecedented firing of Federal Reserve governor Lisa Cook and a lawsuit by Cook challenging the legality of her firing. The president has even spoken of firing Federal Reserve Board Chair Jerome Powell, labeling him a “stubborn moron.” For investors who previously found reporting on monetary policy dry and boring: Be careful what you ask for!

But to get the real facts you have to look beyond the headlines and see what the players post on social media to advance their agenda. In particular, a key rationale that’s been advanced for drastically cutting the federal funds rate – the target rate that now stands at around 4.5% – is that doing so will lower the federal government’s borrowing cost, saving taxpayers billions of dollars. On top of lowering mortgage rates for homeowners it sounds great, but it’s not really that simple.

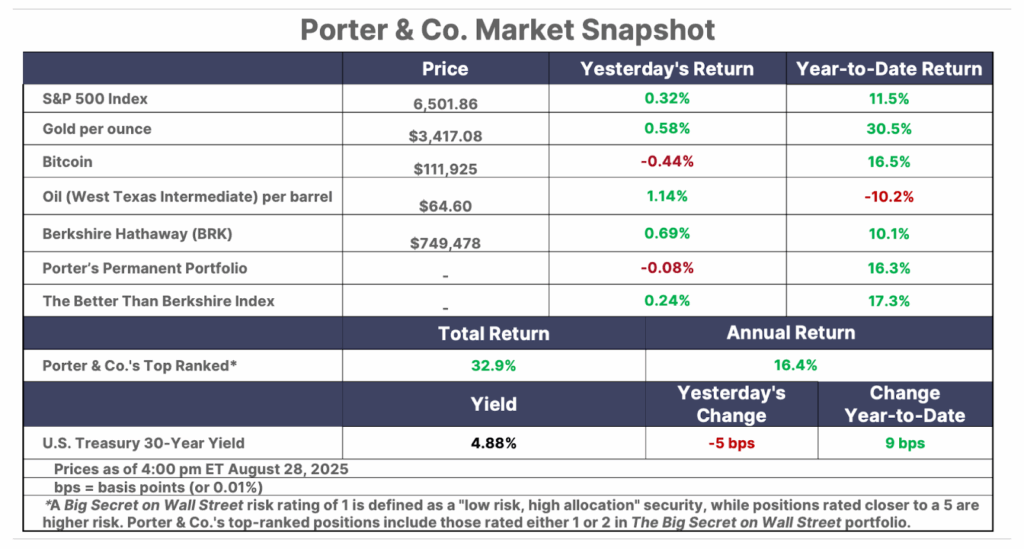

Since January 17, 2025, the last trading day before the Trump administration took office, the yield on two-year U.S. Treasury notes has fallen by 61 basis points. The yield on those short-maturity issues closely reflects the Fed’s stance on the Fed funds rate (the overnight interbank lending rate) that it directly controls. So the debt market is signaling that it expects Powell and the other Federal Open Market Committee (“FOMC”) members to drop the Fed funds rate at their September meeting and possibly later on as well.

But the yield on the Treasury maturity most closely watched by investors – 10 years – declined by about one-third less over the same period, just 42 basis points. And in the longest maturity, 30 years, the government’s borrowing rate has gone up – by three basis points.

That’s the market’s way of saying, “Hold on!”

The hesitation stems from the belief that if the Fed succumbs to political pressure and goes too far in lowering interest rates, it could drive inflation well above the Fed’s 2% target. Owning long-maturity bonds with a negligible (or even negative) real rate of interest after accounting for inflation would be extremely unattractive under those conditions.

“No problem,” you might say. “The government can just concentrate its borrowing in those shorter maturities, where the president’s jawboning for lower rates has had the desired effect. With the two-year rate at 3.67%, why pay today’s 4.19% to borrow for 10 years or do anything as insane as paying 4.88% for 30-year money?”

Well, here’s why it’s the responsible approach (and not insane) to spread the Treasury’s debt issuance across the maturity spectrum. You wouldn’t want to own the stock of a company that relied exclusively on short-term funding, instead of spreading its maturity schedule over several years. That would expose the company to a serious risk of having to refinance lots of maturing debt at a much higher rate following a major change in the bond market environment. The U.S. government faces the same risk if it fails to lock in a substantial portion of its borrowing cost at prevailing rates by issuing bonds with 10- to 20-year maturities, instead trying to save a few bucks today by issuing only short-dated paper.

Unfortunately, Uncle Sam has been heading in the wrong direction for some time. About 80% of the federal government’s debt currently matures in five years or less. Just 25 years ago, that figure was more like 70%.

It wasn’t that long ago that U.S. inflation and Treasury bond yields were in double digits. Heaven help us if, a few years from now, the managers of our public debt have to roll over big chunks of it at rates substantially higher than we’re now paying. Interest on the national debt is already the government’s second largest expense item, after Social Security payments. Getting hit with a huge cost increase on the debt could cause a heck of a fiscal squeeze, in addition to severely undermining the confidence of the foreign lenders we count on to show up with big checks at Treasury auctions.

Of course, the president and Congress could mitigate this risk by tightening their belts and reducing the amount of debt that taxpayers have to pay interest on.

Good luck with that.

So you see, it isn’t as simple as Fed cuts rates, government borrowing cost goes down, spending increases and tax cuts go forward without incident. Chair Powell’s successor and as many other interest rate slashers as President Trump can stack the FOMC with can’t automatically reduce long-term Treasury rates, which they don’t control, by cutting the Fed funds rate, which they do.

In summary, it takes more effort to get to the real story on this than listening to soundbites or even reading actual news articles about the bond market action. But given the stakes for investors, it’s worth the time and trouble to become fully informed.

As we wrote about in yesterday’s Big Secret On Wall Street, one sector of the market that will clearly benefit from lower interest rates is biotech.

The potential for a new biotech bull market means there has never been a better time to become a Biotech Frontiers subscriber. But that’s not the only reason to consider joining Erez Kalir’s service today…

After meeting with Erez this August, Porter has decided to expand Biotech Frontiers into, well, new frontiers – including tech, blockchain, and more. To that end, we are renaming the advisory Tech Frontiers.

To learn about a new opportunity Erez is recommending and to become part of this new frontier, click here.

Is 2025 The Best Time To Get Rich In American History?

One genius investor now predicts that the first 365 days of the Trump presidency will be the best time to get rich in American history.

Over the next 12 months…

One specific investment is set to potentially blast off by up to 12,000%.

If he’s right, two “wealth drivers” colliding now will create the greatest ever wealth-building opportunity for regular Americans. Must be in by August 30. Free instructions here.

Three Things To Know Before We Go…

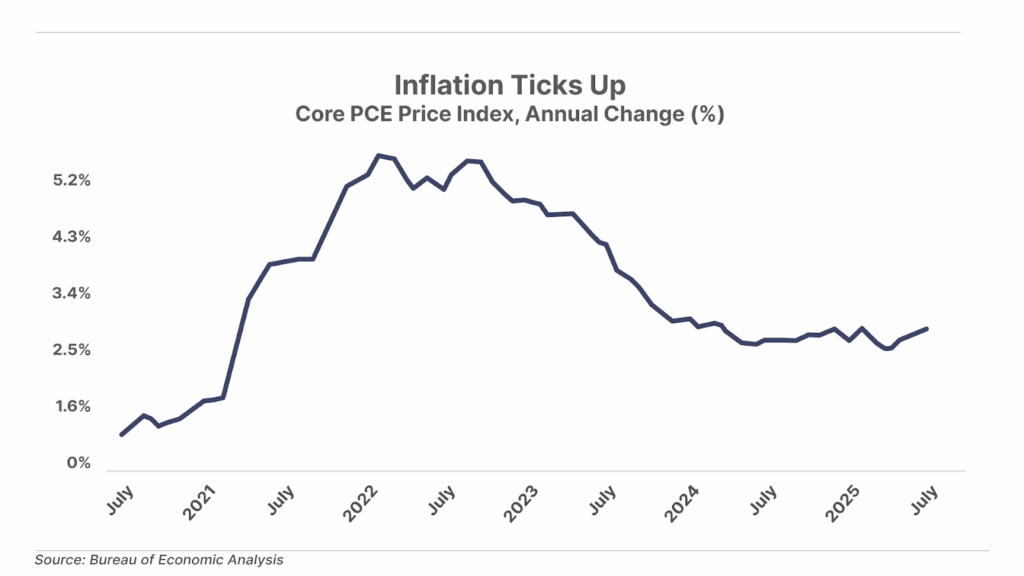

1. Inflation continues to tick higher. This morning, the Bureau of Economic Analysis reported that the personal consumption expenditures (“PCE”) price index – the Federal Reserve’s preferred measure of inflation – rose 0.2% month-over-month (2.6% annual rate) in July. Core PCE – which excludes food and energy prices – rose 0.3% (2.9% annual rate) in July. While both measures matched Wall Street expectations, the latter represents the highest annualized inflation rate since February and the third consecutive monthly increase. Despite the sticky inflation, the market remains convinced the Fed will cut rates next month, with the probability of a 25 basis point cut rising to 86.9% this morning, according to the CME’s FedWatch tool.

2. A major milestone for gold. For the first time in nearly 30 years, foreign central banks officially hold more gold than U.S. Treasury debt as a percentage of reserves. As the chart below highlights, this shift from Treasuries to gold began roughly 10 years ago, and accelerated after the U.S. seized Russia’s reserves following the start of the war with Ukraine. If gold is resuming its role as the world’s preferred reserve asset, history suggests it has much further to run.

3. The U.S. debt train is accelerating at full speed. Federal debt has surged past $37 trillion and will likely hit $40 trillion by year’s end. For perspective, at the start of 2020, U.S. debt stood at just $23.2 trillion – so it has nearly doubled in only five years. And it shows no sign of slowing. In such an environment, the most effective defense against mounting debt and currency debasement is owning hard assets – particularly gold and Bitcoin, which historically serve as reliable stores of value when government liabilities spiral out of control.

And One More Thing… Porter & Co.’s New Logo

As you can see in the “Mailbag” below, readers enjoyed Porter’s Daily Journal on Wednesday… He wrote:

When a group of people has never invested any of their capital into a business but gets to control an asset that’s worth $1.4 billion, they are pursuing a political goal instead of a business goal. That’s socialism.”

So we are changing our logo:

Mailbag

On Wednesday, Porter explained what led to the Cracker Barrel board’s decision to change its logo, inviting a huge backlash that ultimately led to it reversing its decision. Porter wrote:

“If you believe that diversity, by itself, is a virtue for running a business or serving on a corporate board, then I encourage you to start a business and prove it…

My advice: don’t invest in companies with boards like Cracker Barrel’s.”

Readers, for the most part, agreed. We share some emails below.

You are spot-on regarding Cracker Barrel and its board. Not just boards but employees too going back to the 1980s. Merit took a back seat to minority races, sex all too often. I used to relish going up against a competitor who had DEI hiring. I stole their business, expanded and grew mine, and increased profits.

Cracker Barrel is a prime example of this. Too often CEOs and, in this case, chairmen and chairwomen, will hire people to “check boxes” rather than merit. The real crime is that these types of employees feed down the education and experience ladder to others and their real intelligence and abilities are forsaken when they could really develop themselves and advance based on merit too instead of being handed positions.

John R.”

Great message today on the destruction that socialism does to business. Maybe it would be worthwhile to start to identify companies that take this dismal course of action and sell them short and/or buy put options on them.

Kevin L.”

Loved the piece on it, spot-on. Thank you for being normal!

Thomas D.”

Bravo!

Porter saying the quiet part out loud again. That’s why I’m a paid up long-armer.

Matt V.”

“Excellent e-letter! Best I have heard about business, DEI, and board member appointments.

Best wishes, Ken O.”

Nice piece on crackers and mixed vegetables. U hit it on the head.

Frank C.”

Hi Porter,

I agree with a lot of what you say, but I have a thought.

I have read that boards that are diverse (e.g., women and minorities) tend to perform better than those that are just older white guys (like me). I think diversity has its place and helps us avoid blind spots – but the “diversity” board members must be actually qualified beyond their minority status. I don’t want DEI at the expense of competence and experience. I want to build boards with competency and experience who bring a diversity of backgrounds.

David J.”

Hats off to you, Porter. Thank you for speaking up. You are a patriot that has a deep understanding of the times we are in and the need to be a merit based country.

Robert S.”

Amen, sounds like a great theme for an ETF!

The amazing thing is these companies can’t reverse course even when they see a lot of other companies have tried it and failed.

John W.”

Your Cracker Barrel analysis was terrific. I don’t know that I have ever come across such an unfiltered, insightful piece like this before.

I am a long-term subscriber to various Stansberry Research publications, but only recently to Porter & Co. Porter & Co. is unbelievable. Nothing has come close to the value. I am dumping Stansberry and other publications going forward due to sensory overload.

Thanks for your hard work. Glad you gave up retirement.

Stephen G.”

I loved your Daily Journal regarding Cracker Barrel. It is very refreshing to see someone with a deep understanding of what is going on stand up and call out the bullshit we see in government and corporate America. Without awareness of the issues, we cannot begin to address them. Not that anyone in government or corporate board rooms give a rat’s ass, but when the shit really hits the fan you will be able to point back and say “I told you so.”

Kenneth A.”

What an outstanding organization, presentation of facts, and argument of what’s really going on with the attempts of the very small minority to move the majority to socialism. Bravo!

Forrest H.”

Good investing,

Martin Fridson

New York, New York

Please note: The investments in our “Porter & Co. Top Positions” should not be considered current recommendations. These positions are the best performers across our publications – and the securities listed may (or may not) be above the current buy-up-to price. To learn more, visit the current portfolio page of the relevant service, here. To gain access or to learn more about our current portfolios, call Lance James, our Director of Customer Care, at 888-610-8895 or internationally at +1 443-815-4447.