In today’s Daily Journal, a free e-letter from Porter & Co., we’ll explore:

The soaring price of gold and silver… Central banks flee the dollar… Loading up on gold… The Austrians got it right… Their warnings are forgotten… The golden formula… The U.S. spending spree… Money, money, money supply… Today’s poll: inflation… |

Those of you who’ve seen your investments in gold and silver soaring are probably pretty happy.

That’s understandable… But you should be worried.

What’s driving the price of these metals higher isn’t merely today’s inflation. It is the growing recognition of the world’s major banks that the U.S. dollar is no longer a suitable reserve currency.

Over the last 15 years, central banks (like Poland’s) have been buying more and more gold and selling U.S. Treasury bonds. Commercial banks will soon be doing the same. And that will start a global run out of Treasuries. When that happens, the banks still holding Treasuries will be wiped out. That’s why I’ve been warning about Bank of America (BAC) for years. Trust me, it will collapse.

The coming re-monetization of gold will trigger a collapse in America’s economy, led by the destruction of our banks and the end of Social Security and Medicare as we know them today.

These are not “someday” or maybe predictions. They will happen over the next seven years.

This scenario represents a deadly serious threat to anyone holding U.S. dollars in our banking system or anyone who depends on Social Security.

We are on the brink of a monetary catastrophe, fueled by reckless government spending, ballooning pension liabilities, and endless bailouts of a banking system addicted to easy credit.

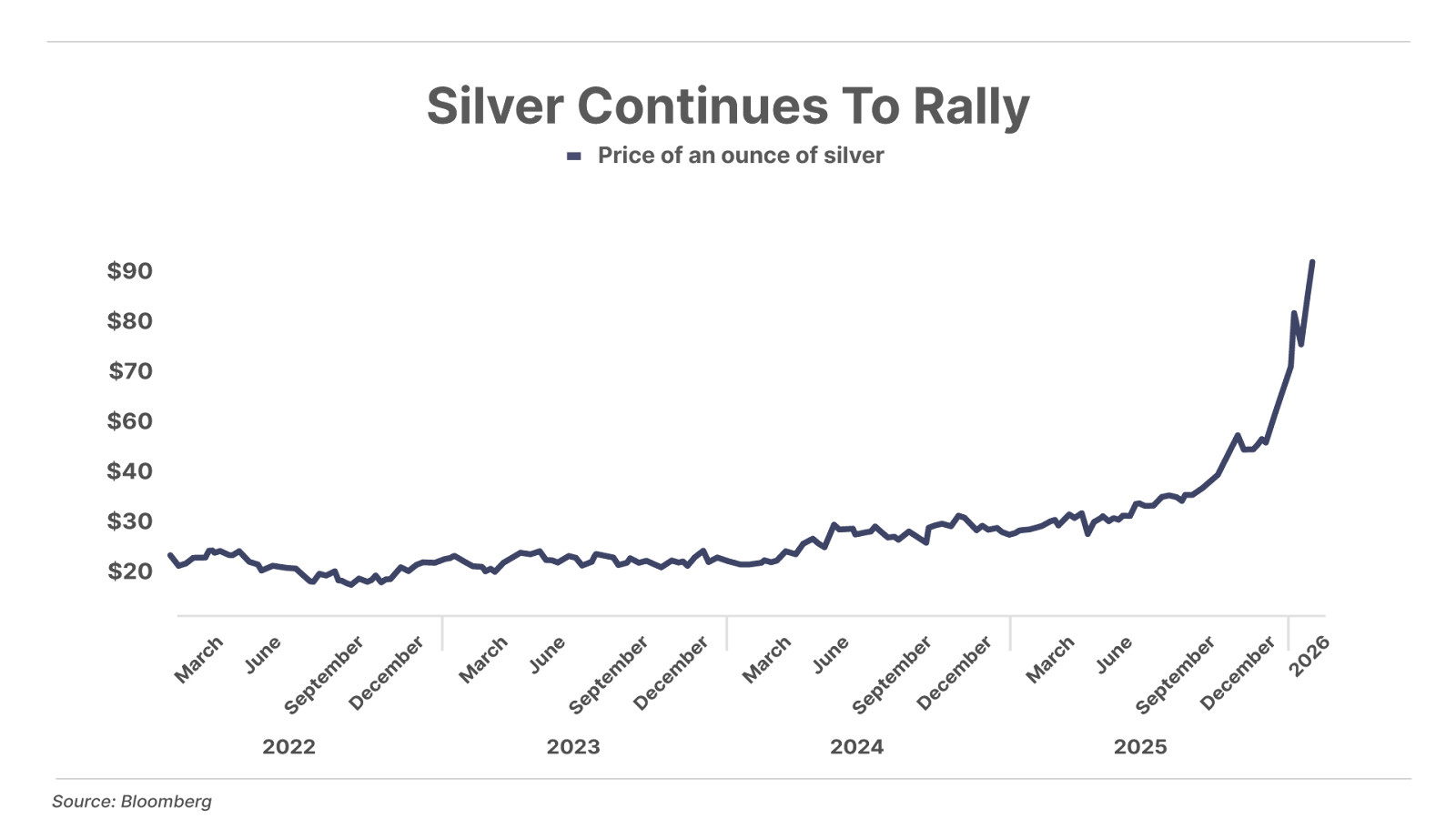

As a result, since 2022, gold has been soaring – it was up over 66% in 2025 alone. But the real harbinger of a monetary reset was the recent move in silver, up a staggering 148% last year.

To understand why these moves in these metals are so worrisome, you must familiarize yourself with an almost-forgotten school of economic thought, the “Austrians.”

The Austrian School of Economics began with Carl Menger, a visionary Viennese professor whose 1871 masterpiece, Principles of Economics, explained economics in an entirely new way – as a system of complex exchanges, not any industrial policy or government action. In particular, Menger dismantled the labor theory of value – that misguided notion, which held that a good’s worth derived solely from the toil invested in its production.

Instead, in an incredible breakthrough, Menger introduced the subjective theory of value: prices arise from individual preferences, from the marginal utility each person assigns to one more unit of a scarce resource.

Water in a desert oasis commands a fortune not because of labor, but because of its life-sustaining value to the thirsty traveler.

This insight transformed economics from a mechanistic science into a study of human choices – actions that are not reliably predictable, but which can only be modeled within statistical ranges. An economy isn’t like an engine and therefore it can’t be controlled like one, either.

Menger’s work laid the foundation of understanding the markets in an entirely new way: as entities driven by spontaneous order, where millions of individual decisions coalesce into efficient allocations without central direction. Much like a flock of birds moving across the sky, discovering the safest and most efficient route.

These ideas were, and continue to be, a direct rebuke to the collectivist temptations that lead governments into massive economic errors.

These foundations of thought reached their zenith in the 20th century through Ludwig von Mises and Friedrich Hayek, whose ideas not only advanced the Austrian theory but shaped the conservative backlash against the interventionist excesses of the 1940s and 1970s.

Mises, an exile from Nazi-occupied Austria, predicted the boom-bust cycles driven by artificial credit expansion – and predicted the crash of 1929 and the resulting Great Depression. In the 1920s, Mises famously demolished socialism in his essay “Economic Calculation In the Socialist Commonwealth” (1920), arguing that without private ownership and market prices, rational allocation of resources is impossible.

Hayek, Mises’ brilliant successor, earned the Nobel Prize in 1974 for extending the Austrian Business Cycle Theory and illuminating the knowledge problem in The Use Of Knowledge In Society (1945). Markets, he argued, aggregate dispersed information through prices, a feat no planner could replicate.

His Road To Serfdom (1944) warned that central planning leads inexorably to tyranny, a prescient indictment of wartime controls and postwar socialism. These ideas fueled the conservative counter-revolution to the government excess of U.S. President Franklin Roosevelt, Soviet leader Joseph Stalin, and Aldolf Hitler.

By the 1970s, amid stagflation – the unholy marriage of inflation and unemployment that Keynesianism could neither predict nor cure – Austrian ideas ignited a renaissance. Hayek’s Nobel Prize came as vindication, influencing leaders like British Prime Minister Margaret Thatcher and President Ronald Reagan, who dismantled price controls, deregulated industries, and tamed inflation through monetary restraint.

Murray Rothbard, with his anarcho-capitalist fervor in Man, Economy, And State (1962) and The Ethics Of Liberty (1982), pushed Austrian logic to its radical limits, advocating 100% reserve banking to end fractional-reserve instability and exposing fiat money as a tool of state plunder.

These men were not mere theorists. They were moralists in the best sense, decrying the hubris of interventionism that distorted markets and eroded freedoms.

Their accomplishments – refuting Marxism, explaining credit cycles, professionalizing economics – shaped a conservative resurgence against the tax-and-spend warfare states of the 1940s and the inflationary debacles of the 1970s.

But today, all their warnings have been forgotten.

The entire world is adrift in a sea of fiat excess. U.S. federal deficits, projected at between $2.2 trillion and $2.7 trillion annually through 2030 by the Congressional Budget Office (I guarantee they will be much bigger…) will swell America’s debt past $55 trillion. Add to these incredible ongoing deficits the net present value of our unfunded Social Security and Medicare liabilities and you must tack on another $5 trillion each year, with total debt reaching $100 trillion combined by 2030.

Worse, repeated banking bailouts – 2008’s TARP and 2020’s COVID rescues – continue to prop up a banking system that continues to ignite credit bubbles across the economy.

Total U.S. credit growth is now running 9% to 11% annually – or about 3x GDP – including the “hidden debt” of our pension systems. This massively devalues the dollar and will lead, directly, to collapse of the currency.

Gold and silver’s surge – gold to $4,600 per ounce, silver to $90 – signals markets awakening to this debasement, as investors flee fiat for sound money.

I was lucky to meet Kurt Richebächer in 1998. The formidable German economist was the last living link to the original Austrians. Kurt died in 2007, but before his death we worked together and I was fortunate to have been one of his last proteges. Kurt accurately predicted both the dot-com debacle and the Global Financial Crisis, warning specifically that the mortgage credit boom was unsustainable and would soon collapse in one of his last letters. It was Kurt’s work that informed my legendary short of both Freddie Mac and Freddie Mae in May 2008.

Kurt taught me many of the Austrians’ “ancient secrets,” stressing credit cycles and the central role that gold plays in economic systems. Inspired, I digitized over a century of economic data, building a gold pricing model rooted in Austrian principles and based on global credit growth:

log(Gold Price_t) = α + ∑(i=1 to 3) β_i Credit Growth_t-i + γ_1 Inflation_t + γ_2 Real Rate_t + γ_3 Dollar Index_t + ϵ_t.

At its core, this formula captures gold’s response to monetary excess.

The left side logs the gold price for exponential scaling. The right sums a constant (α), lagged credit growth (the “heart” of the model, with n=3 years capturing delayed effects), current inflation (pushing gold as a hedge), real rates (negative when low, favoring gold), dollar strength (inversely correlated), and error (ϵ_t).

Credit booms, like today’s, drive gold higher with a lag, as stability risks mount.

This model led to my first gold purchases in 2002, my massive gold investment in 2008, and my one-and-only “buy gold stocks” report in 2015. And over the last year, it led me to leverage my personal account heavily into gold and silver.

It’s not magic. It’s Austrian logic codified.

Looking ahead, silver’s recent explosion – outpacing gold – heralds a seismic shift: gold’s re-monetization as the world’s reserve anchor.

With hyperinflation risks looming in major currencies, driven by unlimited deficits and tariffs and trade wars, central banks have returned to gold to restore footing. Soon – much sooner than anyone now expects – commercial banks will begin buying too, out of fear of the duration risk inherent in inflation-prone sovereign bonds.

By 2030-2033, the world will see a re-monetization of gold, as Basel III global banking regulations will finally approve segregated physical gold as a liquid reserve, placing it on par with sovereign bonds. That will drive silver prices vastly higher, because, when monetized, silver will return to its historic gold-to-silver ratio of 16:1.

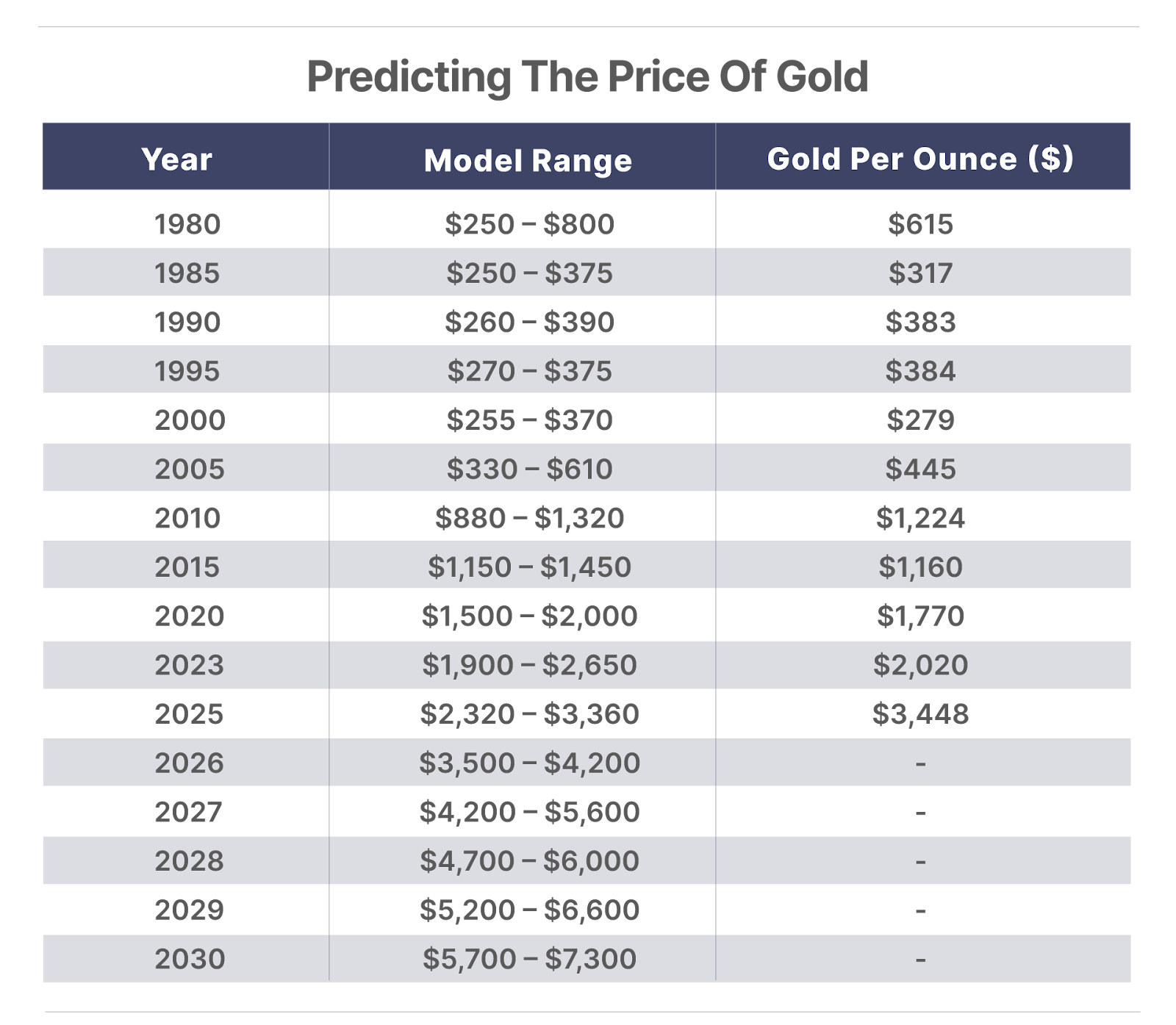

My model (see below), with price forecasts for the month of January, is based on official government forecasts for debts, deficits, and inflation. I expect the gold price will be substantially higher than these forecasts.

At the current 50x gold-to-silver ratio, this model suggests a $146-per-ounce silver price by 2030. But, if I’m right about the re-monetization of gold, the silver price could easily be over $400 per ounce.

As Kurt Richebächer taught me, sound money is not optional. It’s civilization’s bulwark. If you don’t own gold yet, you’re making a big mistake.

Three Things To Know Before We Go…

1. Silver continues its record run. As detailed above, silver ended 2025 as the best-performing commodity of the year – up 148% – and it’s continuing to outperform into 2026. This morning, the precious metal traded above $90 per ounce for the first time in history, and is already up nearly 25% over the first nine trading days of the year. Meanwhile, we’re also seeing unconfirmed reports that the U.S. Mint has temporarily suspended sales of all silver numismatic products (collectibles) due to rapidly rising prices.

2. A mixed bag on inflation. Yesterday, the Bureau of Labor Statistics (“BLS”) reported the consumer price index (“CPI”) rose 2.7% year-over-year (“YOY”), in line with Wall Street expectations, while the more-closely-watched core CPI – which excludes food and energy prices – rose a weaker-than-expected 2.6% YOY. However, this morning the BLS reported that both the headline and core producer price index (“PPI”) – measures of wholesale price inflation – rose 3% YOY, well above expectations of 2.7% for each. Given this increased uncertainty, the market currently believes the Federal Reserve will leave interest rates unchanged when it meets later this month, with the CME’s FedWatch tool currently showing just a 5% probability of a rate cut.

3. The money printer isn’t stopping. U.S. M2 money supply – a broad measure of highly liquid capital – has surged to a record high $22.3 trillion. After falling following the pandemic-era surge, M2 pushed to new all-time highs by late 2025. This marks three consecutive years of growth, with 2025 delivering the largest annual increase since the 2020 stimulus boom. And with the federal government running massive, structural deficits, there is no credible path to rein in spending – and no end in sight to the ballooning money supply that historically has resulted in rising rates of inflation.

Mailbag

In Monday’s Journal, Porter shared details of his recent trip to Argentina, chronicling the decades of mismanagement of the economy there – which he says is now happening in the U.S. We received numerous emails from readers.

It’s interesting that you recently visited and wrote this short piece on Argentina. My oldest son, who is 40 and a software design engineer in the financial field, currently lives in Finland with his Finnish wife and two sons. They are contemplating a move to Argentina due to the evolving threats and aggression from Russia in Finland and increased defense spending and rapid integration into NATO’s military and political structures. In other words, it’s becoming an unrecognizable place on many fronts. Moving back to the U.S. after 15 years in Finland is out of the question.

Larry H.

Argentina is what happens when politicians can’t see the forest for the trees! Yes, I agree that America is on the same path forward. The idea that the government can spend money forever is economist double speak! Ordinary citizens can’t do it so how in hell can government? I read one comment from a well-known economist that our ability to spend is infinite, because we can just print more money! And that’s what they have been doing for decades. That’s why a house in the 1980s that sold for $35,000 is now unaffordable at $600,000. Young people are not having kids because child care is more than their mortgage payment. It’s insanity of the worst kind!

Jon M.

Thanks for your work. Glad you enjoyed your trip to Argentina. Your observations track with my experiences during travels to Argentina, Chile, Uruguay, the Caribbean, Africa, and the Middle East. Most of the world does not enjoy our standard of living, not because the ingredients for success aren’t available, but because the recipe is faulty. It leaves out key factors: the character of the people, the politicians, and the incentive for success (or survival). I fear, as do you and Jim Rickards, that bad times are coming on fast. Australia and New Zealand are looking better all the time. Canada would do in a pinch. As the old saying goes, “When sh** hits the fan the best place to be is someplace else.”

If you haven’t been to Australia and New Zealand I highly recommend that you take a trip to see and enjoy the sights, the people, and the culture.

Ken V.

Porter…

I flew cargo jets in the U.S. Air Force, and one of my favorite runs was the South American capital trips – from Panama to Lima, La Paz Santigo, Buenos Aires, Montevideo, Rio, and back to Charleston.

I loved to fly it in the winter months here. The beef was amazing – the chefs’ platters were fit for a king and cheap by any measure. One trip we were there in 1972 when they brought Juan Peron’s body back from Spain. We were put on standby for possible evacuations if needed.

We don’t get much good reporting on South America so it is interesting to hear your news. Love all your work.

I have been following Garrett Goggin and his Golden Portfolio for a couple of years. I have a portfolio of 40 junior miners with an average increase of 174%. Not being able to afford gold I have made room in my now little-used gun safe for the other precious metals.

As a child, I was dyslexic and couldn’t read much so I stayed away from history and majored in accounting and math. Reading your Journal is like a history lesson. I had no idea that the Romans were cheating their people by manipulating their coins like Our Congress!

You, my friend, are an Amazing Man!! Thanks,

Edward H.

Good investing,

Porter Stansberry

Stevenson, Maryland

Please note: The investments in our “Porter & Co. Top Positions” should not be considered current recommendations. These positions are the best performers across our publications – and the securities listed may (or may not) be above the current buy-up-to price. To learn more, visit the current portfolio page of the relevant service, here. To gain access or to learn more about our current portfolios, call our Customer Care team at 888-610-8895 or internationally at +1 443-815-4447.

Social Security, Medicare, And Our Banking System Will All Fail Within Seven Years