- Porter's Daily Journal

- Posts

- The Inflation Shining: Heeeere’s Johnny

The Inflation Shining: Heeeere’s Johnny

Porter's Journal Issue #13, Volume #3

Inside today’s Daily Journal…

Essay: The Inflation Shining – Heeeere’s Johnny

Caterpillar fights back tariffs

Trump picks a Fed chair

Gold and silver tumble

Chart Of The Day: Sagimet Biosciences

Reader Poll results: Has silver peaked?

Today’s Mailbag

He ended Monday’s Daily Journal with this message:

Producer Prices Surge, Putting The Bull Market At Risk

The big news today is that inflation is returning to the U.S. economy.

As you’ll remember from the “Mailbag” drama in Wednesday’s Journal, that risk lies at the core of my “out of the pool” warning in the event that 10-year Treasury yields rise above the 5% “Biden Bust” level.

My thesis is simple: inflation returns to the economy thanks to trade wars and huge government deficits, crushing the bond market. Higher interest rates then crush a stock market that’s worth more than 200% of GDP (all-time highs) and is trading at multiples that can only exist with very low interest rates.

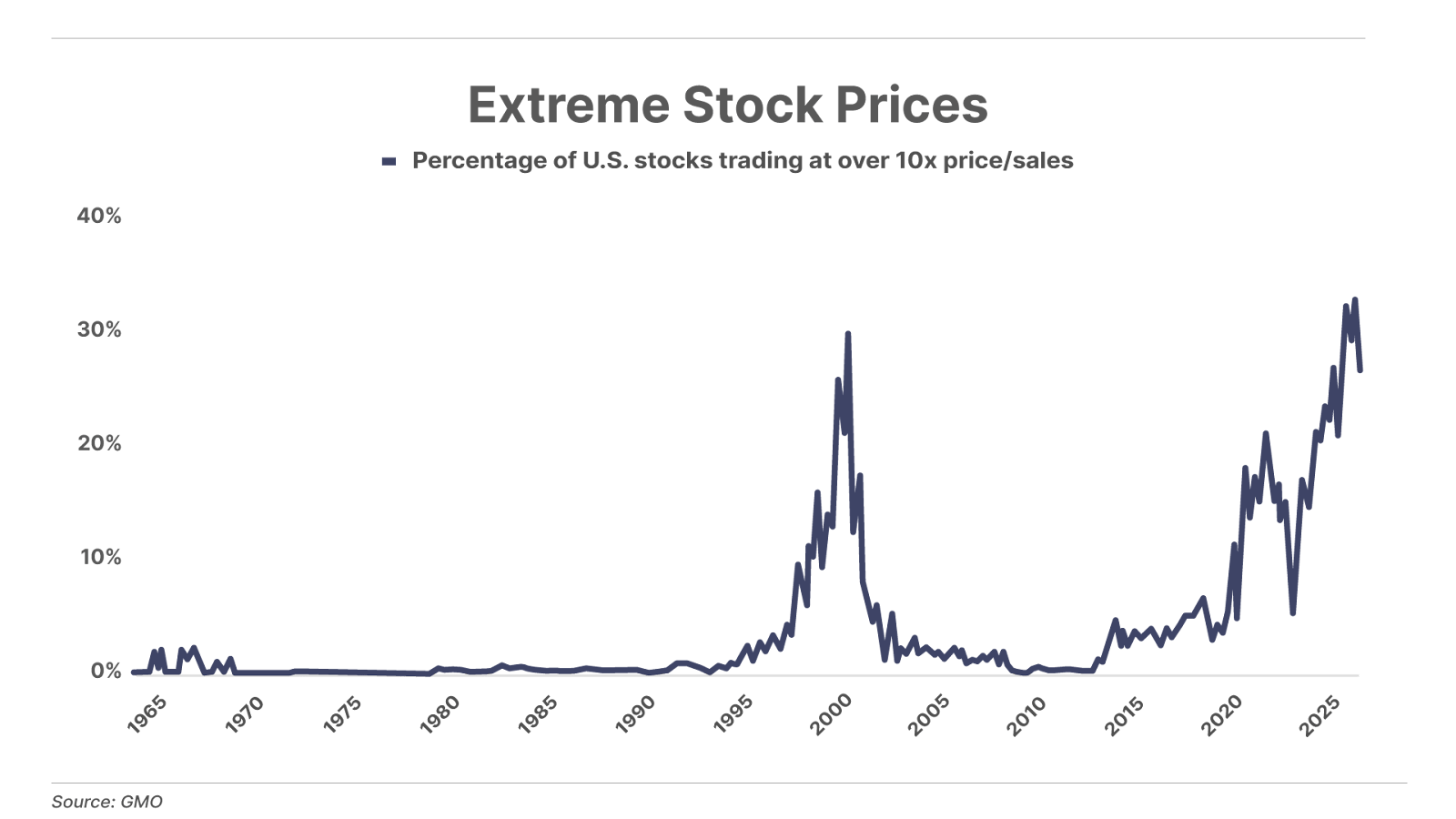

This chart, from my good friend Meb Faber, reveals how extreme U.S. stock prices have become. This shows the huge number of companies that are trading at more than 10x annual sales.

A market, like the U.S.’s, that is priced for perfection will not handle the risk of much higher rates of inflation with equanimity. We are, more and more, at risk of a huge rout in the prices of financial assets.

Specifically, December producer price index (“PPI”) inflation was 3.0%, well above expectations of 2.7%. More importantly, core PPI inflation, which removes the volatile food and energy categories, was 3.3%.

It wasn’t hard to see this coming. And it’s virtually certain to get much worse.

A basket of silver, copper, zinc, and aluminum (key industrial metals) is up almost 100% over the past year.

These huge prices were last seen during the 1970s. We know from the past that these kinds of “producer” price increases will show up in consumer price hikes in the future. Typical throughput time is 18 to 24 months.

To see this happen in real time, I direct you to Caterpillar’s (CAT) recent earnings report. The Yellow Monster is one of America’s best businesses – it has a legendary reputation and many of its largest machines are irreplaceable in large-scale mining operations. Caterpillar must import many of its raw materials (primarily steel and aluminum) because they are not produced in the U.S.

Taxing raw materials that we do not produce does not bring jobs to the U.S. It only brings revenue to the government – at the direct expense of one of our best and most important businesses. In his bid to massively increase U.S. government revenue in ways that are invisible to most voters, President Trump has threatened Caterpillar’s ability to build the machines the economy needs.

These tariffs aren’t about “making America great again.” They are about staving off the bankruptcy of our government, which steadfastly refuses to reform.

In 2025, Caterpillar faced $1.7 billion in tariffs. Its tariff outlook for 2026 is worse: $2.6 billion.

The President’s supporters (and many of my dear paid-up subscribers) insist that these soaring taxes won’t cause any economic harm. They haven’t learned the first law of economics: TANSTAAFL… there ain’t no such thing as a free lunch.

These enormous new costs directly cut into Caterpillar’s margins and profitability. Its full year earnings per share fell from $21.90 in 2024 to $18.81 in 2025. Full-year 2025 profit margin was 17.2%, down from 20.7% in 2024.

The stock was hammered on these tariff risks immediately following President Trump’s “liberation day” last April, falling below $300 per share.

But today the stock is trading over $650, after being the Dow Jones Industrial Average’s top-performing stock in 2025.

Why do you think that happened? I’ll give you two guesses…