This is Porter’s Daily Journal, a free e-letter from Porter & Co. that provides unfiltered insights on markets, the economy, and life to help readers become better investors. It includes weekday editions and two weekend editions… and is free to all subscribers.

Stay out of the spotlight… Never sell a great business… One “lost stock” is up more than 60% this year… Richest inefficiencies where Wall Street isn’t looking… Porter’s top 10 “lost stocks”… The yield curve gets steeper… Buffett’s bad investment… |

Table of Contents

“Stay out of the spotlight.”

My good friend Van Simmons is the world’s most renowned dealer of rare gold coins. He invented the Professional Coin Grading System, which allowed collectors to more accurately grade the quality of their collections.

Over the last 40 years, Van has traveled all around the world meeting with the world’s wealthiest coin collectors, some of whom are also the world’s wealthiest people. You won’t find their names on the Forbes list though. Or any other list for that matter. The first rule of lasting wealth is: stay out of the spotlight.

And the second rule? Never sell a great business.

Put these two ideas together and you’ll quickly understand the underlying advantage of investing in what I call “Lost Stocks.”

You may recall that I first described the strategy in the Daily Journal in January.

What are lost stocks? They are businesses that create incredible wealth, not through the expansion of their equity multiple with the Wall Street marketing machine or by constantly raising new capital. Instead these businesses create wealth by their own internal cash generation plus excellent capital allocation.

These companies are run by excellent investors hiding inside businesses that everyone ignores.

Lost stocks use things like share buybacks and special dividends that don’t register as yield or total return on investment databases. These strategies make their incredible performances harder for analysts to discover.

And these businesses are absolute masters of capital allocation. They create enormous value by investing their cash flows in the best possible ways, whether that’s buying back their own shares or buying other businesses.

In January, I gave you five “lost stocks” to watch – but at the time, only one of them (Comfort Systems) offered anything like a reasonable price.

Texas Pacific Land (TPL) – up 2,900% last 10 years, 66x earnings

Casella Waste Systems (CWST) – up 2,632% last 10 years, 926x earnings

Champion Homes (SKY) – up 2,434% last 10 years, 35x earnings

Comfort Systems USA (FIX) – up 2,406% last 10 years, 33x earnings

Copart (CPRT) – up 1,141% last 10 years, 40x earnings

Perhaps not surprisingly, the only good performance (so far) from this group was Comfort Systems (FIX), which is up more than 60% this year.

I’ve been building a complete index of lost stocks, much like we’ve built for the Better Than Berkshire Index. And, again, while I’m not recommending any of these stocks as a buy today, I think it’s important that we begin to track these businesses closely so that when there’s a correction in their share prices, we can add them to our list of recommendations.

Also, I’m interested in your help. Do you know of any ultra-high quality “lost stocks” that meet these criteria? I’m looking for:

Great businesses: companies with sustained, high returns on equity and returns on invested capital (20%+). We’re not looking for accounting gimmicks and balance sheets loaded with debt. We’re looking for brilliant owner-operators and a moat that lets profits compound.

Low volatility: Beta below 1.25. We want stable businesses, held tightly by knowledgeable shareholders.

And, of course, we want businesses, management teams, and owners who know how to stay out of the spotlight. We’re looking for the corporate equivalent of a discreet private club.

This approach isn’t only about style. Small, underfollowed companies often have lower prices due to investor neglect, not business risk. As Joel Greenblatt famously laid out in his book You Can Be A Stock Market Genius, inefficiencies are richest where Wall Street isn’t looking. Charles Royce, Ralph Wanger, and Warren Buffett all made fortunes in unloved and ignored high-quality businesses. As Fidelity’s legendary fund manager Peter Lynch explained:

Most of my best investments were companies I hadn’t heard of until someone introduced me.”

Finding these investment opportunities can be difficult – they’re “lost” for a reason.

I like to follow other professional investors who specialize in this kind of fundamental, long-term investing. But, again, these investors tend to keep a very low profile. If you have the golden goose, there’s no reason to toot your horn.

But here are two investors you should take the time to learn from.

Greg Dean was the Morningstar Breakout Fund Manager of the Year in 2015. He does his own rigorous primary research, seeking high-quality, cash-generative companies run by talented, long-term-oriented management teams. Sounds familiar, doesn’t it?

Dean was a partner for many years at Cambridge Global Asset Management, but most recently he founded a new firm in 2021, Langdon Equity Partners. Langdon’s Global Smaller Companies Fund (launched 2022) is a concentrated portfolio (25 to 40 holdings) of international small-cap winners, consistently targeting double-digit cash flow per share growth. Since inception, the fund has delivered 14.3% annual net returns, outperforming global small-cap indexes by almost 8% per year. Big Secret recommendation Burford Capital (BUR) is one of Dean’s top three holdings in his smaller companies fund.

I also recommend keeping an eye on Eric Cinnamond – he runs Palm Valley Capital Management and focuses exclusively on overlooked micro and small caps with clean balance sheets, high profitability, and low index exposure.

Cinnamond is a true rebel in the investment management industry. He famously returned $400 million in investor capital in 2016! Nobody else does that, ever. But he did so because he believed the market offered no compelling value.

I will never knowingly overpay for a security in order to maintain a fully invested portfolio or to enhance near-term relative returns.”

Palm Valley’s fund has routinely been one of the few U.S. equity funds to make positive returns in volatile or “titanic” market years. For example, in 2022, when most funds saw significant declines, Palm Valley generated gains by holding large cash positions and then deploying capital opportunistically.

And if you’re wondering… Palm Valley has rarely been positioned more strongly in cash. It currently holds 64% of the fund in Treasury bills. That makes Buffett’s roughly 30% allocation to cash seem speculative!

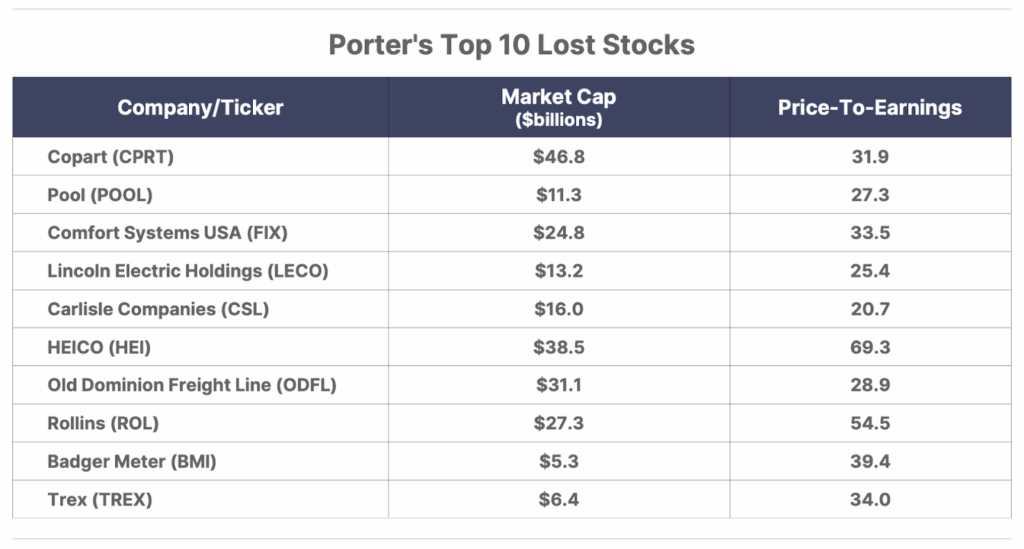

I’ve built a universe of 100 of these kinds of “lost stocks,” and then, from that universe I’ve ranked them in terms of price (price-to-earnings) and quality (return on equity). Here’s my current top 10 lost stocks.

Again, my advice isn’t to buy these stocks today, but instead to put them on your watchlist and look to buy them during market corrections or when, for whatever reason, they dip into a reasonable price range. That’s going to be different for each company, but, overall, you’ll rarely see these names trading below 25x earnings.

Pre-IPO Alert: The Next Tech Giant

Matt Milner just revealed how to grab a stake in the company behind ChatGPT before it hits the stock market.

He believes it’s racing toward a $1 trillion valuation — with explosive growth potential rivaling Google, Facebook, and Uber’s early investors.

⏳ Opportunities like this come once in a generation. Don’t miss out.

Three Things To Know Before We Go…

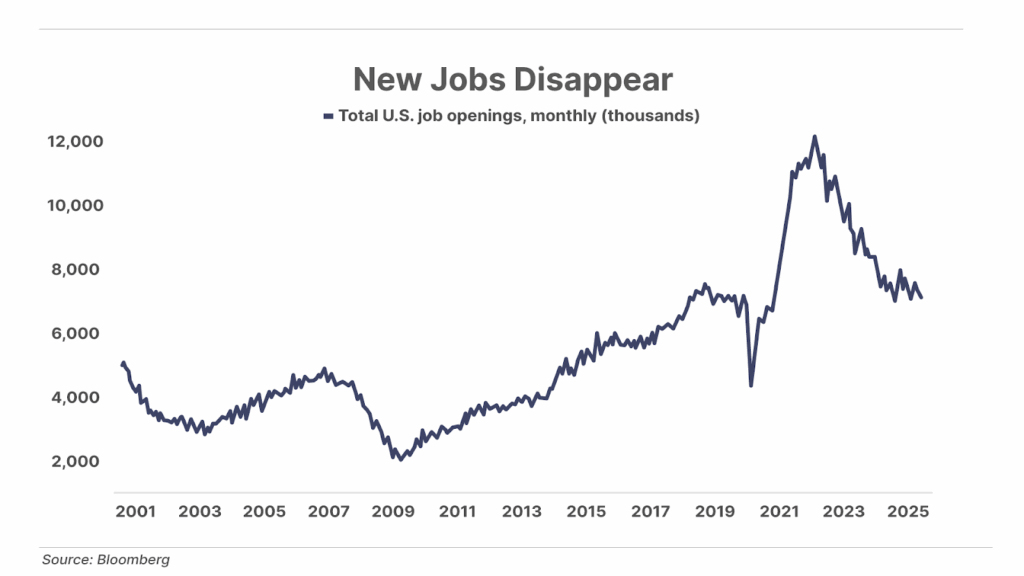

1. Job openings continue their decline. This morning, the Bureau of Labor Statistics released its latest Job Openings and Labor Turnover Survey (“JOLTS”), showing job openings fell to 7.18 million in July – below Wall Street expectations of 7.38 million and matching the lowest levels of 2025. Following this weak report, the odds of a September interest rate cut rose to 96%, suggesting the Federal Reserve is a “lock” to cut rates by 25 basis points when it meets later this month.

2. More Americans are falling behind on payments. In July, 90-day credit card delinquencies rose across every credit tier, leading to a one-point drop in the average U.S. credit score. What’s more alarming is the shift among traditionally reliable borrowers: delinquencies among prime borrowers (scores 661-780) rose 48% year-over-year… and delinquencies among superprime consumers, those with the highest credit quality (scores 781-850), surged 109%. At the same time, the share of subprime consumers has crept higher – from 18.1% to 18.7% over the past two years – signaling a broader erosion in household credit quality and that financial distress is building beneath the surface. So it’s no surprise that serious credit card delinquencies are at a 14-year high:

3. Yield curve flashes warning sign. The interest rate spread (aka, the yield curve) between 2-year and 30-year U.S. Treasuries has moved from deeply negative to a positive spread of 1.25%. The last two times this happened, in 2001 and 2008, it coincided with 50% declines in the overall stock market.

And One More Thing… Slicing Up Kraft

Warren Buffett said yesterday that he is disappointed that Kraft Heinz (KHC) has decided to split the company in a way that unwinds much of the blockbuster merger Buffett masterminded a decade ago. With a 27.5% stake, Buffett’s Berkshire Hathaway is Kraft Heinz’s largest shareholder. Buffett told CNBC’s Squawk Box that the merger didn’t turn out to be a brilliant idea – shares are down 62% since 2015 – but he doesn’t think breaking the company apart is the solution. Porter’s Better Than Berkshire Index points out that Kraft Heinz was not a great investment for Berkshire… and offers alternatives for it and many of Buffett’s other holdings.

Good investing,

Porter Stansberry

Stevenson, Maryland

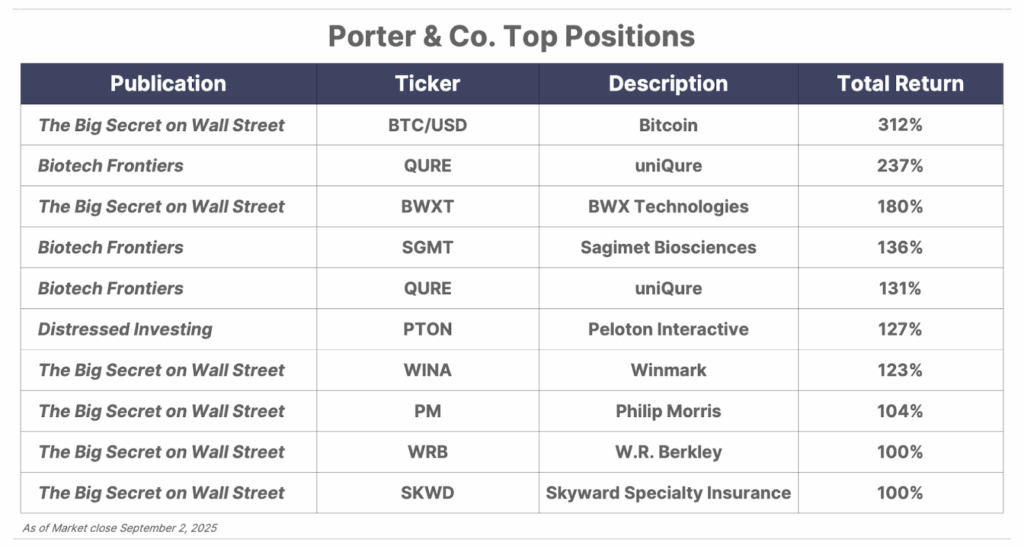

Please note: The investments in our “Porter & Co. Top Positions” should not be considered current recommendations. These positions are the best performers across our publications – and the securities listed may (or may not) be above the current buy-up-to price. To learn more, visit the current portfolio page of the relevant service, here. To gain access or to learn more about our current portfolios, call Lance James, our Director of Customer Care, at 888-610-8895 or internationally at +1 443-815-4447.