They Are A Tax On Consumers… Not Other Countries

This is Porter’s Daily Journal, a free e-letter from Porter & Co. that provides unfiltered insights on markets, the economy, and life to help readers become better investors. It includes weekday editions and two weekend editions… and is free to all subscribers.

$1.2 trillion in added expenses… Tariffs are a burden… They go against comparative advantage… Inflation will be back… Remember Fordney-McCumber Tariff of 1922… China gets chip efficient… |

Table of Contents

U.S. companies are now expected to pay at least $1.2 trillion more in expenses this year than was anticipated on January 1… all because of tariffs.

That’s according to a recent white paper released by S&P Global. Goldman Sachs released similar research, which estimates that the consumer burden of tariffs is now 37%, but will increase to 55% by the end of 2025. Consumers are now paying more for less.

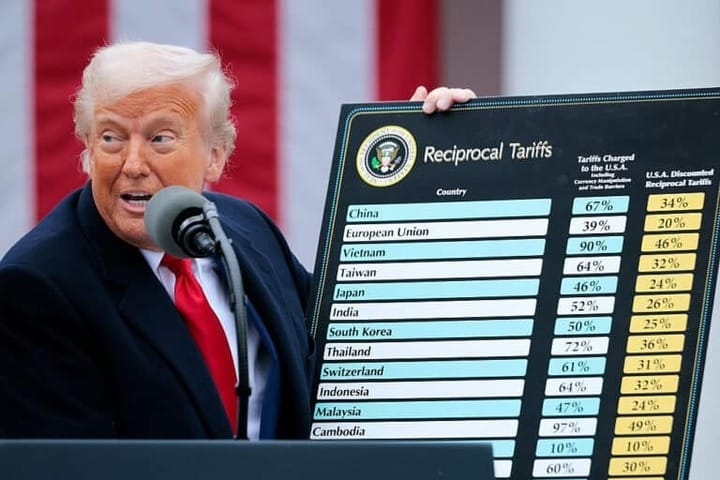

And it’s only just begun… In early February, President Donald Trump launched a trade war against America’s two closest allies, Canada and Mexico – then extended that trade war to countries around the world in his big Liberation Day April 2 announcement. With some tariff levels as high as 100%, and with his finger pointing at dozens of countries around the globe, share prices plunged. But the real damage that tariffs will cause is not just the destabilization of markets – it is the burden it will place on businesses and ultimately consumers.

Just to be clear, a tariff is a tax on U.S. citizens. It is not paid by the country whose goods Trump targets. The tariffs are paid by the company that is importing those goods into the U.S. The company can then eat those new costs or pass them on to the end buyer. Increasingly, it seems, those costs are going to consumers.

The country where the goods are produced does not pay anything. The only repercussions to them – say, China or Canada – is that U.S. companies might eventually buy fewer goods from them.

Wonderful, Trump says, that will open opportunities for American businesses. Well, be careful what you wish for. There are millions of things Americans, and the U.S. economy, either aren’t any good at (because of supply chains, labor rates, culture, climate, natural resources) or, even worse, have very low returns on capital – stuff we don’t want to be any good at.

These economic realities – known to economists as comparative advantage – explain why global trade is so important to increasing wealth and living standards all around the world.

There’s a reason nobody tries to grow bananas in Denmark. Doing so won’t make Denmark richer – it will make it poorer, as the energy and effort will be supremely inefficient and take capital and resources away from where they can be profitably employed.

So it is unbelievably naïve to believe that trade enriches one country at the expense of the other. Instead, both parties gain – or else the transactions would not occur. And today the links between various economies are extremely intricate and important to the function of all the major economies.

How Tariffs (Don’t) Work

After Trump was inaugurated and began his tariff talk, The Wall Street Journal called his proposed tariffs on Mexico and Canada “the dumbest trade war in history.”

As we said above… a tariff is simply a tax on imported goods. When these taxes are imposed, they aren’t usually absorbed by the foreign manufacturer – but instead passed on, in whole or in part, to U.S. consumers through higher prices.

For example: If a toy manufactured in China used to cost, say, $15 at Walmart, and that toy, along with all other Chinese-made goods, is now subject to a 100% tariff, the $15 tax on the toy isn’t going to get eaten by the manufacturer – and certainly not by China. It’s going to be reflected in a new, higher price at Walmart – probably something close to $30.

Porter explained it this way back in February:

A different kind of example… America is producing a lot of crude oil, and most of it is “light sweet” crude. But it so happens that our refineries – that make gasoline – were designed and built to process heavier crudes, much of which we import from Canada. So if you think we’re going to enrich ourselves by impoverishing Canada with a 25% tariff, you’re a moron: all of those costs will be passed along to you, the consumer. Meanwhile, a wholesale tariff at that level will simply destroy the economics of all kinds of supply chains, making the U.S. economy vastly less efficient. That will make everyone – us and our trading partners – poorer.”

What we should want is for Canada (and any other trading partner) to become wealthier by making us wealthier – by everyone doing what they are best at and keeping the government out of the way.

What people all around the world need is vastly less government, not borders we can’t cross and goods and labor we can’t exchange fairly.

The other consequence of tariffs is inflation. That inflation is the obvious and natural result of tariffs isn’t just common sense. It’s also borne out by historical economic data.

In 2019, economist David Furceri and his colleagues at the International Monetary Fund published the most comprehensive analysis ever on the impact of tariffs. Their study encompassed 151 countries and nearly 60 years of data, from 1962 forward. They found that tariffs cause a substantial increase in inflation… and the higher the tariffs, the bigger that increase.

Looking back, the all-time granddaddy of economic collapses can be directly traced to tariffs.

One hundred years ago, the U.S. enacted the Fordney-McCumber Tariff of 1922, which put up to a 50% tariff on virtually every item imported into the United States. As President Trump would have said, “We’re going to make our trading partners pay their fair share.”

How did it work out?

All of our trading partners raised their tariffs on our goods in retaliation – some to as high as 100%. American farmers, who had been net exporters, now had to fight against the weather and every other country’s taxing authority. According to the American Farm Bureau, U.S. farmers lost more than $300 million (about a 12% decline) annually in export revenue as a direct result of this tariff.

But even that wasn’t the worst outcome.

When governments begin imposing tariffs on leading industries and export goods, they end up impacting virtually every kind of production all around the world in ways that are impossible to predict.

We said it above, but it’s worth repeating: the single most important concept in free-market economics is comparative advantage. The reason Porter is better at financial research and economic history is because he’s been doing it all day, every day, for 30 years. But this is all he is good at.

For everything else, he’s going to need someone who has been doing what they do for 30 years. And it’s the free market – aka, trade – that enables Porter to focus on what he does, and allows them to focus on what they do.

But tariffs wreck the whole system in part because they simply increase prices, and also because they are applied capriciously, which creates tremendous uncertainty – which completely stops investment.

By 1926, basic farming supplies – like harnesses, plows, and wagons – had doubled in price. But the price for farm products did not go up. So farming fell into an even deeper and worse depression. And it’s beginning to happen to farmers today – with many on the brink of bankruptcy.

How could it have been otherwise? Taxes are never good for any industry. And no, my dear president, it doesn’t matter whether you call them tariffs or not. They add enormous costs, which drives down demand.

It was the dumb, leading the dumber, directly into oblivion. And cheering for it!

A Historic Gold Announcement Is About To Rock Wall Street

For months, sharp-eyed analysts have watched the quiet buildup behind the scenes. Now, the floodgates are set to open. The greatest investor of all time is about to validate what Garrett Goggin has been saying for months: Gold is entering a once-in-a-generation mania. Front-running Buffett has never been more urgent and four tiny miners could be your ticket to 100X gains.

Be ready before the historic gold move. Click here to get Garrett’s Top Four picks now.

Three Things To Know Before We Go…

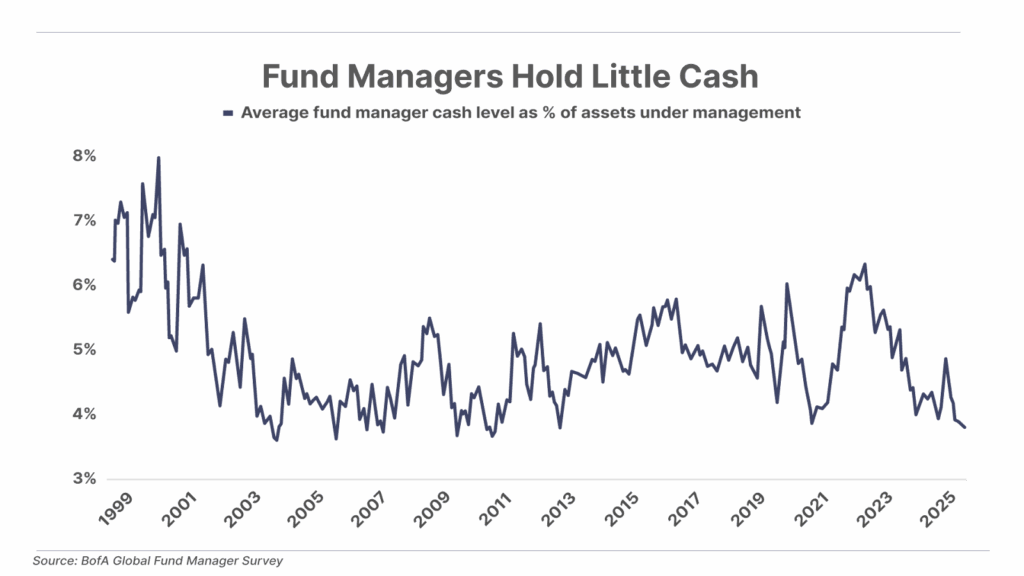

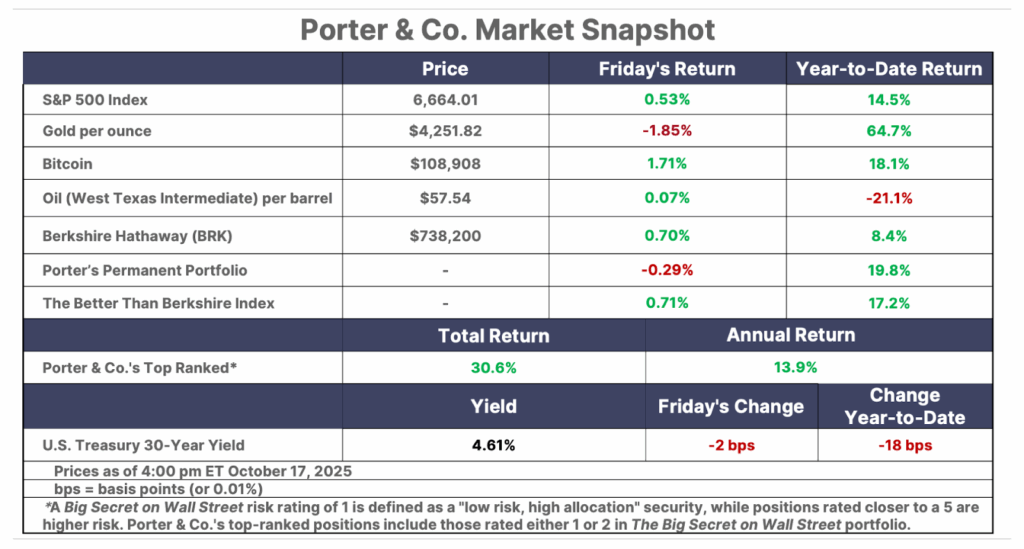

1. Fund managers go all-in, despite bubble fears. The percentage of cash held in portfolios of money managers fell to just 3.8% in October, according to Bank of America’s Global Fund Manager survey – the lowest level in 12 years. The survey also revealed that 60% of fund managers believed global stocks are overvalued, a record high in the history of the survey, and 20 points above the peak levels of the dot-com bubble. They say stocks are overvalued, but they keep buying and buying… This is unlikely to end well.

2. A notable divergence in small-caps. Small-cap stocks have been on a tear since April’s “Liberation Day” lows, however not all small-caps have been doing equally well. As shown in the chart below, the small-cap Russell 2000 is up 41% since April (14% year-to-date) while the S&P 600 (which includes only profitable small-cap firms) is up only 31% (4% year-to-date). In other words, it has been the riskier, more speculative small-cap companies that have been leading this rally higher.

3. Alibaba claims a huge reduction in Nvidia chip usage. After three months of beta testing, Chinese tech giant Alibaba (BABA) announced that its new Aegaeon cloud-computing system cut the number of Nvidia (NVDA) H20 GPUs (chips) it needs by 82% – a dramatic efficiency gain. The breakthrough underscores China’s growing autonomy in AI infrastructure and its reduced reliance on Western technology.

Good investing,

Porter & Co.

Stevenson, Maryland

Please note: The investments in our “Porter & Co. Top Positions” should not be considered current recommendations. These positions are the best performers across our publications – and the securities listed may (or may not) be above the current buy-up-to price. To learn more, visit the current portfolio page of the relevant service, here. To gain access or to learn more about our current portfolios, call our Customer Care team at 888-610-8895 or internationally at +1 443-815-4447.